The Growing Importance of Personalization in Financial Services

5 min read

Today’s financial services marketers are facing new demands. They don’t just need to stay current with new marketing trends in the financial services industry, they need to stay on top of new finance and marketing technology to give consumers what they demand, and capture more market share.

Historically, financial services providers have been strong proponents of providing friendly, curated service. However, new technology is compromising their ability to deliver personal, customer-centric experiences across new mediums like online banking. Let’s take a close look at one primary trend that’s reshaping the financial services industry – personalization in marketing and communications.

Why is Personalization Key for Financial Services?

The financial services space is highly competitive. Many options have emerged to suit many different banking and financing needs of customers, from branch offices of major institutions to entirely online banking. With so much selection available, banks strive to differentiate themselves by providing and advertising best-in-class rates and services – but, these differentiation techniques cause a lower return on assets. And as banks constantly try to undercut each other, they’ve found themselves locked in a race to the bottom.

For example, think of credit cards. Who doesn’t offer a credit card? Every bank, and most major retailers are all competing for customers with steady incomes, solid payment histories, and frequent credit card use. This has caused a saturated market where banks are forced to become increasingly competitive – causing them to tighten their margins, or take a gamble on customers with low FICO scores.

Not only that, but new entrants into the financial services industry have put the squeeze on existing companies. The most formidable new entrant is Amazon, with their Amazon Cash and Amazon Lending offerings that mirror pre-paid debit cards and investment services. As of 2019, Amazon was lending over $1 billion per year, and promises to continue growing and capitalizing on market share that once belonged to traditional financial service organizations.

As a result of this competitive environment, financial services companies have started to build value by competing based on customer experience. By connecting with customers in a personalized, relevant way, banks can move away from the product-obsession that sacrifices their margins, and towards a customer-centric focus that builds their brand value.

This approach has proven effective – as of 2019, three quarters of the world’s largest banks underwent a customer experience transformation. Following the completion of these initiatives, participants found that their new, satisfied customers had 5 to 8 times the lifetime profitability of an unsatisfied customer. However, accomplishing this requires cutting-edge marketing attribution methods that enable precise personalization.

Marketing Attribution Methods for Financial Services

A personalized relationship builds trust. This used to be inherent in the financial services industry, as customers would visit physical branches and speak to friendly tellers directly. However, today’s consumers have shifted away from this face-to-face approach, opting instead to use ATMs, online banking – and even banks with very few physical locations. Unfortunately, banks have struggled to keep pace with these digital changes, and find it increasingly difficult to understand how modern consumers interact with banks and credit unions.

To understand how consumers interact with banks, its vital that financial services marketers leverage person-level data collected from both online and offline interactions. These insights will allow marketers to better understand purchase drivers, behaviors, attitudes, and where customers are in the buyer’s journey.

There are several measurement methods required to ensure marketing teams are capturing and properly leveraging all of this person-level data.

Media Mix Modeling

Media mix modeling (MMM) allows marketers to determine how certain facets of their marketing mix impact overall sales performance. This is found via analyses such as linear regression or multiple regression. As a result of this statistical analysis, marketers can find valuable insights into what influences key factors like overall sales volumes, a channel’s impact on sales, and the overall marketing ROI.

However, media mix modeling has a firm set of limitations. It is best suited to measuring offline media, and marketers must wait weeks or months to receive high-level insights regarding campaign outcomes. This makes it hard to optimize campaigns at a detailed, person-level across all marketing channels.

Multi-Touch Attribution

While many banks use media mix modeling, in the 2000s a new, digital form of measurement became popular – multi-touch attribution (MTA). This method evaluates digital marketing efforts from the bottom-up, and provides a more person-centric approach by evaluating every touchpoint an individual hits on their journey to purchase. Then, it determines which touchpoints, channels, and messages had the greatest impact towards a desired outcome.

MTA allows marketers to view insights and adjust their marketing tactics while a campaign is in flight, but it doesn’t allow organizations to evaluate content effectiveness and track a brand’s strength. Although MTA is more advanced than media mix modeling, it unfortunately has a strong bias towards digital touchpoints – leaving the impact of in-person interaction to be largely enigmatic.

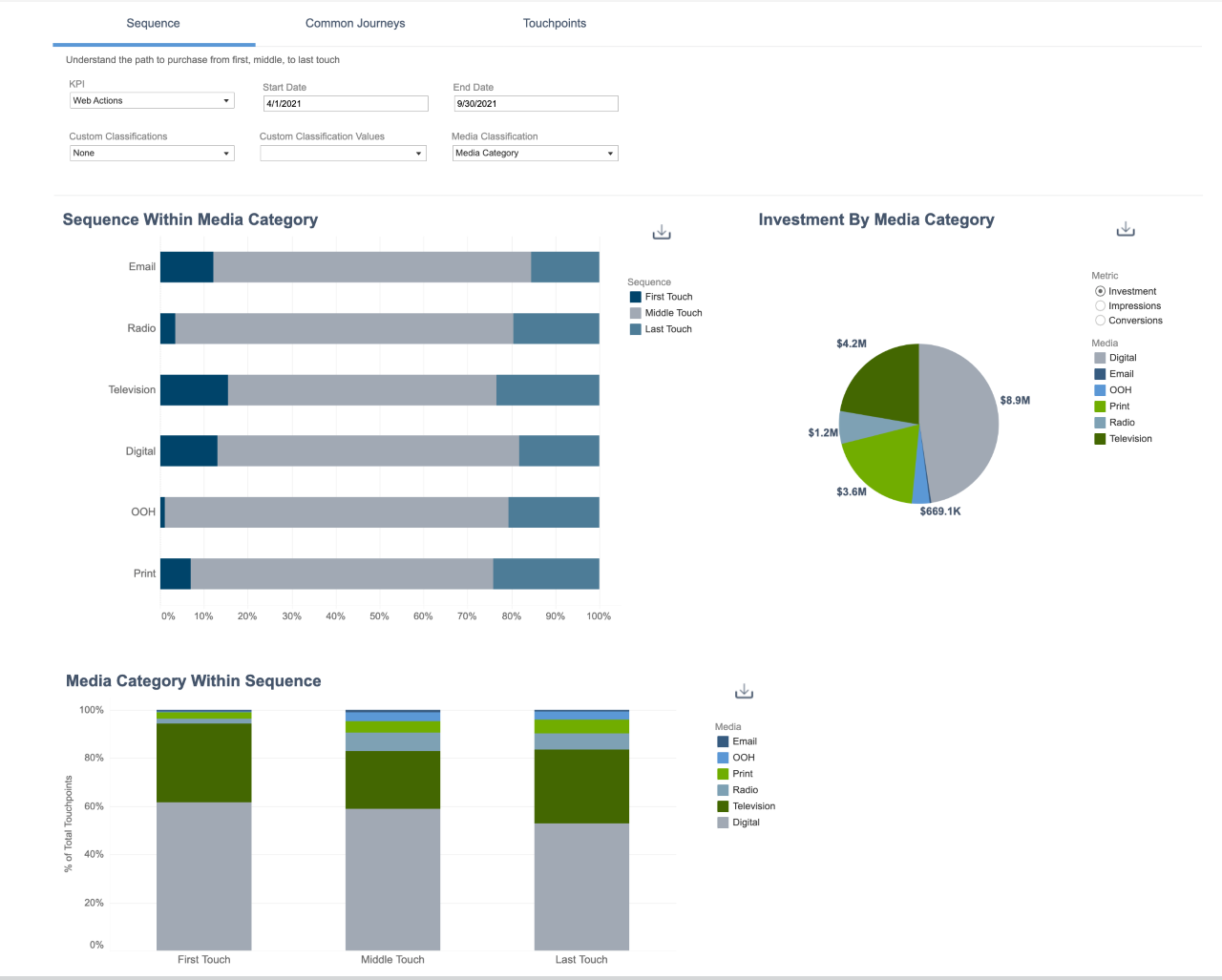

Unified Marketing Measurement

Unified marketing measurement (UMM) combines multiple data sets, techniques, and approaches to accurately assign value to both online and offline touchpoints. With UMM, organizations can get an accurate view of purchase drivers, behaviors, and attitudes that influence a customer’s decisions – enabling marketers to optimize their messaging on an individual or microsegment level.

According to Forrester, implementing UMM can provide opportunities to improve the efficiency of marketing budgets by 15 to 20 percent. However, brands that use UMM for person-level optimization have seen up to a 30 percent improvement in budget efficiencies.

Using Unified Marketing Measurement for Personalization

As previously mentioned, UMM has a lot of merit – but how does it work in practice?

Let’s take a look at Region’s Bank, a financial services institution with 1,500 offices, 1,900 ATMs, and an online banking presence. Region’s Bank used media mix modeling, allowing them to glean high-level insights into their customers. However, they wanted to increase their market share by connecting with potential consumers along their journey in a personalized, relevant way.

With this goal, Region’s Bank sought out marketing platforms that offer person-level unified marketing measurement. After investigating insights based on customer data, they found that their greatest differentiator was their approach towards customer relationships. They drilled deeper into the customer data, creating personalized campaigns curated towards micro segments of the most impactful, valuable customers.

Once the campaign was in motion, they monitored customer interactions to determine which messages were working effectively. Then, they used the Marketing Evolution platform to make in-the-moment optimizations of their brand and product messaging. By taking this new, unified approach to measurement, Region’s Bank managed to double their revenue from new account openings.

The moral of the story is that people want to feel like their bank puts their needs first. A big part of this is creating great content and messaging that directly speaks to customers. Be sure to target content towards precise audiences, as they have different needs and requirements. For example, a high net-worth married couple may be interested in understanding the expenses involved with expanding their family. On the other hand, members of Gen Z in their early twenties may be searching for high-level content that improves their financial literacy.

Final Thoughts

Today’s banks aren’t just competing amongst each other – they’re competing against technological powerhouses that are harnessing data to their advantage. To keep pace with this changing environment, financial services institutions must revamp their approach towards campaign measurement to understand their customers at a person-level. With a personalized approach to marketing, financial services companies can reduce friction in the customer journey and achieve higher engagement.