How Regions Bank Improved ROI with Unified Marketing Measurement

Like hundreds of other senior marketing professionals, Michele Elrod, executive vice president and head of marketing for Regions Bank, was frustrated. As a marketing executive with over two decades of experience she expected more from marketing analytics, and she wasn’t getting what she needed. Her plight was presented at the Advertising Research Foundation’s recent AUDIENCExSCIENCE where thought leaders came together to address the most critical media measurement issues faced by marketers today. The Advertising Research Foundation (ARF) is the industry leader in advertising research among brand advertisers, agencies and research firms.

Our VP of Partners and Alliances, Ken Nelson, spoke to Regions Bank’s use of unified marketing measurement to better understand their brand influence and customer messaging at the person-level.

Retail Banking Challenges with Marketing Mix Modelling

Regions Bank was relying on a marketing mix model that only reported high level results just a couple of times a year. The tools upon which they were basing their marketing decisions weren’t delivering timely insights, nor was it providing a holistic view of their marketing performance. Ultimately, Michele knew her team needed a tool that could deliver the comprehensive understanding needed to make confident, timely decisions about the next best dollar to invest in marketing efforts.

Banks Can Achieve Person-Level Insights with Unified Marketing Measurement

Retail banking and financial services, like many other businesses, are exceedingly personal. Connecting with potential consumers along their journey in a personal and relevant way is the key to gaining new accounts in today’s day and age. Regions was looking for a tool that would help them identify the best messages to deliver to the right target audience, and, ultimately, give them the ability to optimize their marketing while campaigns are live.

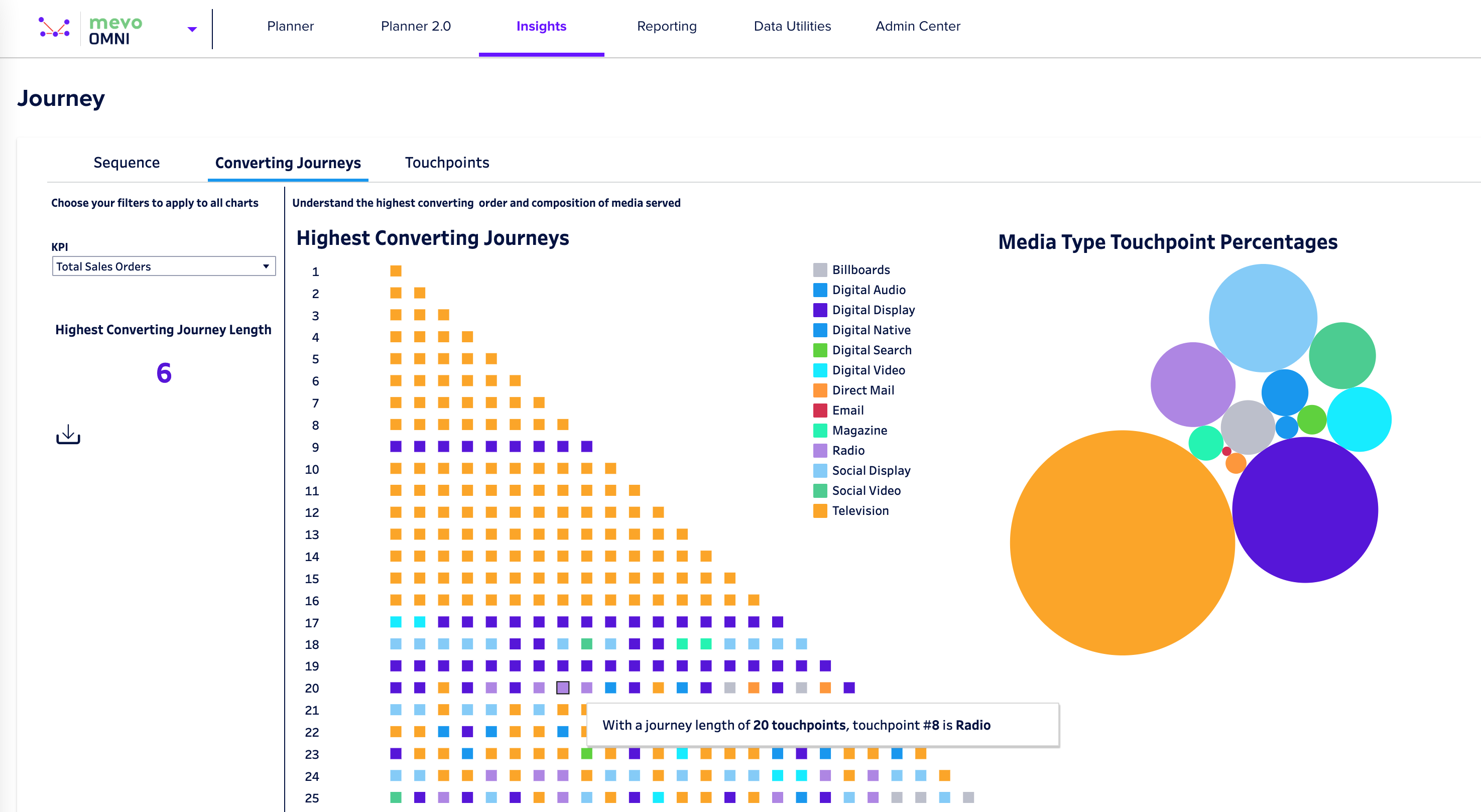

Leading marketers like Michele are adopting a Unified Marketing Measurement approach to uncover higher ROI. This measurement gives marketers a deeper understanding of their marketing performance at the person-level with the ability to measure across the entire marketing mix. For Regions Bank that includes traditional media, such as TV and radio, messages displayed on ATMs, digital advertising, and even the talk tracks of their customer service representatives and bank tellers.

Regions Bank discovered that the relationship with consumers, their brand strength, was the key to unlocking a unique competitive advantage in a crowded marketplace. The location of their branches in consumers’ neighborhoods and leveraging their commitment to local banking was the key to improving marketing ROI for their marketing spend. In fact, this understanding combined with the ability to make in-the-moment optimizations of brand and product messaging allowed the company to double incremental revenue from new account openings.